北京房地产市场回顾

Beijing Property Market Review

2022

年第三季度

2022Q3

办公楼市场回顾

Office Market Review

来源:仲量联行,2022年第三季度

3

14,381

平方米

sqm

CNY 327

平方米/月

sqm/month

9.7%

0

平方米

sqm

• 全市租赁市场在后半个季度归于平静,第三季度净吸纳量出现明显下

降,

比二季度减少70%。

As the leasing market cooled down in the second half of 3Q22, the quarterly

net absorption saw a notable decline, recording a 70% q-o-q change.

新增供应

New Supply

净吸纳量

Net Absorption

租金

Rent

空置率

Vacancy Rate

2022年第三季度市场更新

Market Updates: 3Q22

• 整体租金持续呈小幅下降,环比降低0.4个百分点。全市九个子市场

中有七个录得租金负增长。

The downward trend in overall rents continued, with a rent growth of -0.4%

q-o-q. Seven out of the total nine submarkets across the city reported

negative rent growth.

• 以大型企业为代表的租户倾向于做出更为谨慎的租赁决策。第三季度,

2,000平以下的成交数量占总成交数的83%。

Tenants, especially some large-scale companies, tended to become more

cautious about making leasing decisions. In the third quarter, deals under

2,000 sqm accounted for 83% of total transactions in terms of amount.

• 尽管全市需求活跃度降低,但部分近期入市项目空置面积在第三季度得

到去化,全市

空置率小幅下降至9.7%,环比降幅0.1个百分点。

Despite weakening demand across the city, recent completions in the CBD

Core Area continued to fill up, slowing the downward trend of vacancy rates

with a slide of only 0.1 ppts to 9.7%.

4

来源:仲量联行,2022年第三季度

在过去多年,

金融街与中关村一直作为全市最火热的子市场,供不

应求的状态下有时租户甚至一房难求,新释放的空置面积往往能

在

1-2个月内得到快速去化

。

In the past few years, Finance Street and Zhongguancun submarkets

have consistently been tight and hot in the city. In this state of short

supply, it is hard for tenants to find suitable leasing space, while the

newly released vacancies were usually backfilled quickly, within 1-2

months.

然而近半年以来,该两个区域内

空置面积去化速度明显放缓,空置

压力存续。为了吸引租户,业主的租赁策略变得更加灵活,包括提

供

租金优惠或更长的免租期。

However, in the past six months, the destocking pace of vacancies in

these two submarkets has significantly slowed down, leaving the

landlords with heavy vacancy pressure. To attract tenants, landlords

have become more flexible in their leasing strategies, including

offering rent concessions or longer rent-free periods.

中关村与金融街区域市场压力存续

Market pressure in Zhongguancun and Finance Street areas continued in 3Q22

在线教育及TMT巨头退租

Zhongguancun

中关村

Space surrendered from online

education firms and TMT giants

原有租户外迁

Finance Street

金融街

Relocation of existing tenants

望京

CBD

丽泽

中关村

金融街

第三使馆区

东长安街

东二环路

奥林匹克地区

石景山

通州

亦庄

2

4

5

6

8

9

甲级办公楼

Grade A projects

非甲级办公楼

Non-Grade A projects

1

来源:仲量联行,2022年第三季度

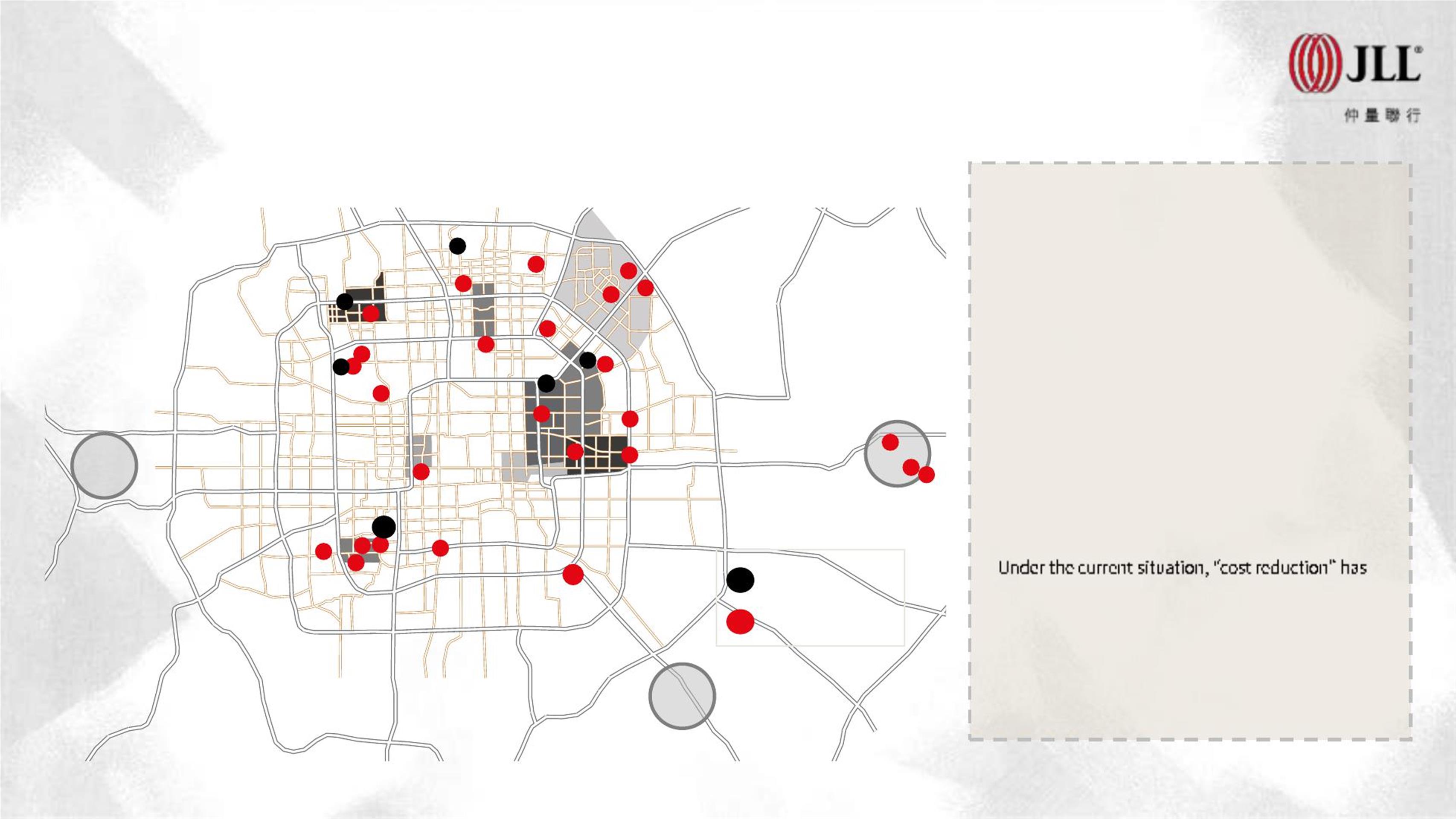

未来5年全市仍将迎来一批优质办公楼项目入市

High-quality future supply across the city is expected in the next five years

未来全市甲级与非甲级办公楼供应地图(含规划地块)

Map of future office supply across the city (including planned plots)

未来5年,全市范围内将拥有近80万平方

米甲级办公楼项目

入市,除此之外仍将迎

来

充足的非甲级项目投入使用,为租户提

供优质的面积选择。

In the next five years, there will be nearly 800,000

sqm Grade A office space entering the market. In

addition, there will be sufficient non-Grade A

projects in the future, providing tenants with high-

quality space options.

在当前的大环境下,

“降本”成为一些企业

租赁决策过程中的

主要考量因素。非甲级

新项目可以提供连续整层面积且拥有价格

优势,预计将

吸引部分价格敏感型的租户。

become the main consideration in the leasing

decision-making process for some companies.

New Non-Grade A projects can provide continuous

whole-floor areas with a price advantage, which is

expected to attract some price-sensitive tenants.